Shop now, pay later with Klarna

We’ve partnered with Klarna to give you a better shopping experience.

Klarna Payments is smooth and simple to use plus there are no hidden charges.

When you choose Klarna at checkout, you’ll get the option to shop now and pay later for your purchase.

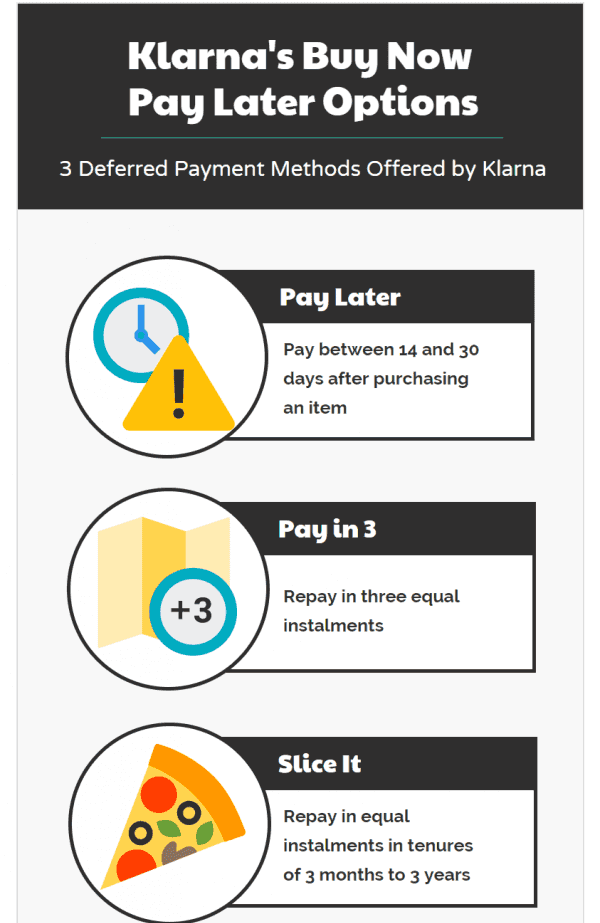

Pay in 3 instalments

Split your purchase into three equal payments so you can spread the cost of your purchase over time.

Enter your credit or debit card details and make automatic payments every 30 days.

Your first instalment will be collected when the merchant and instalments confirm your orders 2 and 3 are scheduled 30 and 60 days later, respectively.

No interest or fees. No impact on your credit score.

How to shop with Klarna

1. Add item(s) to your cart and head to the checkout.

2. Select Klarna at the checkout to pay as you like for your purchase.

3. Manage your orders and payments in the Klarna app.

See all of your purchases in one place, pay any open balances, explore unique content and much more in the Klarna app.

You can also log into your Klarna account.

If you need any help regarding Klarna, contact Klarna Customer Service.

Safe and secure

Klarna has strong anti-fraud controls in place to protect our customers and prevent fraudsters from making unauthorized purchases.

Frequently Asked Questions

Don’t see your question here? Visit the Klarna FAQ page to find out more about using Klarna. You can reach Klarna Customer Service or by downloading the Klarna app.

What happens if I make a return?

If you return some or all of your order, Klarna will issue you with a new statement as soon as the online store processes your return. Follow the retailer's return instructions and make sure to keep the tracking number of your return.

Log into your Klarna account and select “Report a return” so that your statement is paused. As soon as the retailer has registered your return, we will send an adjusted invoice.

There's something wrong with my order. Do I still need to pay for it?

You do not need to pay for goods that are received damaged, broken or faulty. Follow the retailer's dispute instructions and make sure to “Report a problem” in your Klarna account to pause your statement until you’ve resolved the dispute with the retailer.

As soon as the retailer has registered your cancellation or your return, the refund will be processed within 5-7 business days.

I have not received my order. What happens to my statement?

You do not need to pay the statement until you have received your order.

Contact the retailer for an update on the delivery. Make sure to log into your Klarna account and “Report a problem” to pause your statement until you’ve received your order.

My statement is incorrect. What should I do?

If your statement does not match your order details, please contact the retailer directly for a correction of your statement. Make sure to log into your Klarna account and “Report a problem” to pause your statement until the details have been corrected.

What happens if I don’t pay for my Pay in 30 days order?

Your payment is due 30 days after the order is placed or shipped. Klarna will alert you before payment is due to help remind you to pay on time. You will not be charged fees or interest for late and/or missed repayment(s).

Pay in 30 days is a credit product and you are required to make your payment to Klarna.

Klarna may share information about missed payments with credit reference agencies. This means you may find it difficult or more expensive to use Klarna or other lenders' credit products in the future.

If you do not pay for your purchase, Klarna may engage with an external debt collection agency to collect on their behalf. Full details can be found in the Klarna terms and conditions.

What happens if I don’t pay for my Pay in 3 order?

Klarna will alert you before payment is due to help remind you to pay on time. You will not be charged fees or interest for late and/or missed repayment(s).

If Klarna is unable to collect your payment on the scheduled due date Klarna will make a further attempt to automatically collect payment. Should this next payment attempt fail, Klarna will make a final attempt to collect payment and may continue to attempt to collect overdue and currently due payments on subsequent due dates, or invoice you separately for the unpaid total. If you don't make your payments you will be in arrears as Pay in 3 is a credit product.

Klarna may share information about missed payments with credit reference agencies. This means you may find it difficult or more expensive to use Klarna or other lenders' credit products in the future.

If you do not pay for your purchase, Klarna may engage with an external debt collection agency to collect on their behalf. Full details can be found in the Klarna terms and conditions.

About Klarna

Founded in Stockholm, Sweden, Klarna is one of Europe's fastest-growing companies and a leading alternative payment provider. Klarna’s vision is to make shopping smooth, adding value for consumers and retailers with unique payment options and superior customer experience.

Klarna has 3,000 employees across 17 countries and is the pioneer in pay later options, trusted by 90 million shoppers with 200,000 merchants working with us worldwide.

More about Klarna

Please spend responsibly. Borrowing more than you can afford could seriously affect your financial status. Make sure you can afford to make your monthly repayments on time.

Klarna Bank AB (publ) is the lender and we act only as the introducer. The credit product is provided by Klarna Bank AB (publ). Credit is only available to permanent UK residents aged 18 and over, depending on their status. Terms and conditions apply.

Klarna Bank AB (publ) is authorised and regulated by the Swedish Financial Supervisory Authority. Deemed authorised by the Prudential Regulation Authority. Subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website. Please note that the FCA does not regulate Pay in 30 days and Pay in 3 instalments.

Strictly Necessary

These cookies are required for our website to operate and include items such as whether or not to display this pop-up box or your session when logging in to the website. These cookies cannot be disabled.

Performance

We use 3rd party services such as Google Analytics to measure the performance of our website. This helps us tailor the site content to our visitors needs.

Functional

From time to time, we may use cookies to store key pieces of information to make our site easier for you to use. Examples of this are remembering selected form options to speed up future uses of them. These cookies are not necessary for the site to work, but may enhance the browsing experience.

Targeting

We may use advertising services that include tracking beacons to allow us to target our visitors with specific adverts on other platforms such as search or social media. These cookies are not required but may improve the services we offer and promote.